How does Customer Value Optimization change your approach?

Customer Value Optimization (CVO) is a process designed to create an outstanding customer journey and maximize the return on investment of all marketing activities.

It focuses on optimization throughout the customer life cycle to increase brand and loyalty, and create customers for life.

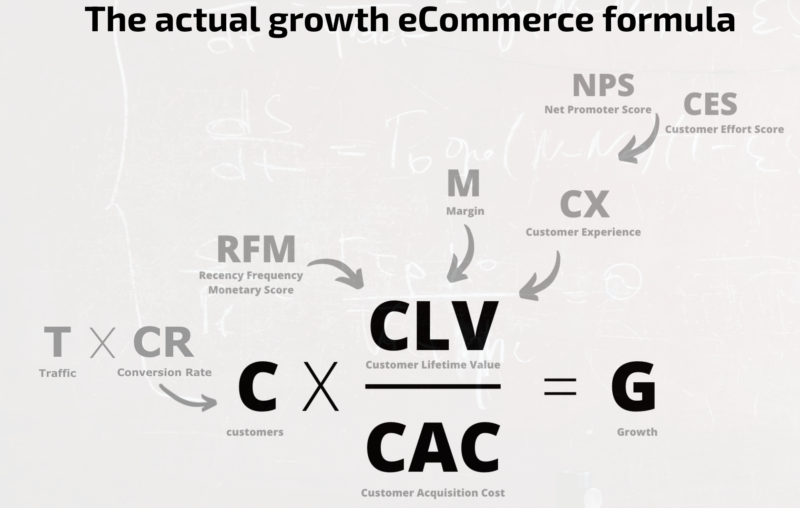

A typical ecommerce growth formula looks like this:

T x CR x AOV = G

T = Traffic

CR = Conversion Rate

AOV = Average Order Value

G = Growth

Although formulas can be very useful as benchmarks for optimization, many companies have made the mistake of locking in long-term business growth on increasing T. But an increase in traffic does not necessarily mean an increase in sales, profits or customer loyalty.

Due to customer behavior changing over time it means that all data are not static.

Increasing customer loyalty by only 5% can increase profits by 25% to 95%.

– Harvard Business School

The main goal today is to analyze and understand the entire customer journey, not only acquiring new customers. Improving their customer experience, in each touchpoint, it'll probabily ensure that customers continue to buy from the same store in the next future.

So, why they should buy from you and not from Amazon and similar Marketplaces? They provide an outstanding Customer Experience, what are currently providing to your customers instead?

34% of companies are implementing “customer journey mapping” into their customer service.

How do you calculate customer value?

From Jay Abraham’s three pillars for growth:

- Increase the number of clients;

- Increase the average transaction per customer;

- Get each customer to buy from you more often.

C = Customers (traffic x conversion rate)

CLV = Customer revenue – (CAC + cost of serving that customer)

CAC = Customer Acquisition Cost

G = Growth

This formula allows companies to get rid of their obsession with traffic and focus on increasing customers who generate the greatest revenue and lowest purchase and maintenance costs.

The cost of customer acquisition has increased by over 50% in the past five years, and acquiring a new customer is now x5 times more expensive than retaining an existing one.

– Source Frederick Reichheld of Bain & Company

So how can you improve all three variables in the C x CLV/CAC = G formula?

In the next article I'll talk about a method to improve it and the way to follow.